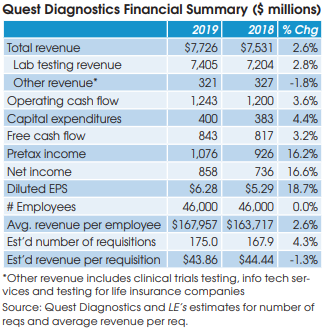

Quest Reports Full-Year 2019 Financial Results

Quest Diagnostics reported net income of $858 million for full-year 2019, up from $736 million in 2018. Quest’s overall revenue increased by 2.6% to $7.726 billion, with acquisitions contributing more than 2% to revenue growth. Quest’s average revenue per requisition decreased by 1.3% to an estimated $44.86 per req. A summary of key topics discussed by CEO Steve Rusckowski and CFO Mark Guinan on a January 30 conference call follows.

Volume Growth

Overall, Quest’s gene-based and esoteric testing grew by approximately 5% to $2.5 billion in 2019. The growth drivers included drug monitoring, tuberculosis testing (QuantiFERON and T-SPOT), Hemepath, blood cancer testing and Cardio IQ cardiovascular testing, according to Rusckowski.

Immunoassay Vendor Consolidation

Siemens Healthineers has won a contract to provide up to 120 Atellica Solution immunoassay analyzers to 19 esoteric and core laboratories owned by Quest in the U.S. The Atellica system will also be installed at the new 250,000-square-foot lab that Quest is building in northern New Jersey. The consolidation to one immunoassay vendor is expected to save Quest $35 million per year.

Increased Competition for Hospital Send-Out Testing

Guinan said that hospitals are focusing more on pricing when selecting a reference lab. “In the past you might extend the [reference lab] contract with the understanding that you had a good reasonable price and they had good quality and all those kind of things. More and more of these are going to RFP where there’s an opportunity for price competitors to come in and compete on price very highly.”

Wage Pressure

“We have pressure in some geographies to up our wages more than we have historically because we have to be competitive with other companies,” said Rusckowski. He noted that Quest employs about 12,000 phlebotomists, more than 3,500 couriers, and thousands of specimen processors. “And so, if you look at the front end of our value chain, that’s where we see some pressure.”

UnitedHealth’s Preferred Laboratory Network Guinan said that United was focusing on how to reduce out-of-network usage. “They’ve done a number of things to try to reduce that, including sharing that information with members of the PLN, where we can go out and target some of those accounts and explain to the physician why there’s a benefit in steering patients to a preferred lab member.”

Guinan said that United began rolling out the PLN benefit, which offers members zero-dollar out-of-pocket cost for lab tests, to its fully-insured plans in January. “And then there’s the sponsored plans, which is the next step. So this is a long-term initiative that is certainly reaping some benefits. But it’s not in terms of a steep change where this is going to overnight move on dramatically.”