U.S. Laboratory Reference Testing: Market Profile & Trends

$1,195.00

Market & financial intelligence you can use to evaluate your send-out testing relationships, how much you pay for referral work, plus how to save hundreds of thousands of dollars on reference testing expenses.

Newsletter Subscribers

SAVE $200

COUPON CODE: LABECON200

Discount applied at Checkout

U.S. Laboratory Reference Testing:

Market Profile & Trends • 2024-2027

Featuring:

Exclusive findings from our first national survey of the $6 billion reference testing market.

Market & financial intelligence you can use to evaluate your send-out testing relationships, how much you pay for referral work, plus how to save hundreds of thousands of dollars on reference testing expenses.

Most hospital and independent lab directors and managers are acutely aware of the volume and cost trends for referred tests at their own facilities, but have scant access to reliable and comprehensive information on what’s happening in the broader marketplace.

Don’t be left in the dark. Managing reference lab expenses requires more than blind faith and market hunches. Even the odds when you negotiate your next reference lab contract by arming yourself with the latest facts in this invaluable, easy-to-read market research report.

Inside, you’ll find:

- National pricing data on the top 200 most frequently referred tests

- Benchmarking data on average referral volume and costs by lab size and type

- Which tests your peers aim to bring in-house over the next 12 months

- How national reference labs are rated by service, turnaround time, price and overall best value

- An analysis of the new FDA LDT regulations and how they will affect the reference testing market

Condensed Table of Contents

1: Profile of Survey Respondents

- Geographic Profile of Survey Respondents

- Survey Respondents by Facility Type

- Survey Respondents by Test Volume

2: Size & Structure of the Reference Testing Market

- Average Referral Volume by Lab Type

- Average Reference Lab Expense by Lab Type

- Reference Lab Expense by Lab Size

- Average Reference Lab Expense % Change

3. Test Menu Characteristics

- Test Menu Size

- Biggest Barriers to Adding New Esoteric Tests

- Average Medicare Revenue per Test by Lab Type

- Top 20 Most Frequent Send-Out Tests

- Top 20 Tests Expected to Be Brought In-House

4. Reference Laboratory Profiles

- Market Share of National Reference Labs

- Profile of ARUP Laboratories

- Profile of Labcorp

- Profile of Mayo Clinic Laboratories

- Profile of Quest Diagnostics

5. Reference Laboratory Quality Indicators

- Who has the Fastest Turnaround Time?

- Who Is Most Responsive?

- Who has the Lowest Prices?

- Which Reference Lab Offers the Best Overall Value?

6. Pricing Data for Reference Testing

- Price Ranges for 200 Most Frequent Send-Out Tests

- Why do Prices Vary So Much?

7. FDA Regulation of LDTs

- Number of Labs Affected by LDT Regulation

- Avg. Number of LDTs Offered on Test Menu

- FDA LDT Regulation Matrix

- Current FDA User Fees

- Estimated Annual Cost of FDA Regulation of LDTs

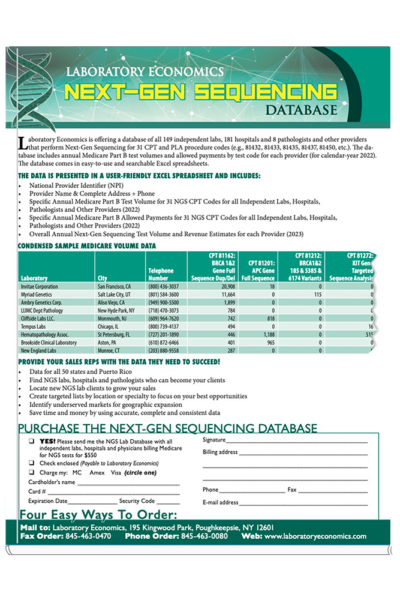

8. The Next-Gen Sequencing Market

- Annual Lab Revenue from NGS Testing

- Medicare Spending & Volume for NGS Testing

- Top 31 NGS Tests by Medicare Payments

- Number of Labs Performing NGS Testing

- Top 25 Independent Labs for NGS Testing

- Top 25 Hospital Labs for NGS Testing

9. The PCR Testing Market

- Annual Lab Revenue from PCR Testing

- Medicare Spending & Volume for PCR Testing

- Top 40 PCR Tests by Medicare Payments

- Number of Labs Performing PCR Testing

- Top 25 Independent Labs for PCR Testing

- Top 25 Hospital Labs for PCR Testing

10. The Outlook for the U.S. Reference Testing Market

- U.S. Reference Testing Market Size, 2018-2027

The Laboratory Economics Difference

Over the past 10 years, reference testing expenses paid to the major national reference testing laboratories (ARUP Laboratories, Labcorp, Mayo Clinic Labs and Quest Diagnostics) has been a small operating cost (averaging between 4-8%) in most lab budgets that grew roughly 5-7% per year. Historically, there has always been a general equilibrium between the number of tests that hospitals and independent labs were bringing in-house and the number of new tests that the national reference labs were introducing to the market.

But that equilibrium is now being upset by new FDA regulations for laboratory-developed tests (LDTs). Complying with these regulations will raise the cost of performing existing LDTs. In addition, the introduction of new LDTs by hospitals and independent labs is being curtailed due to the lengthy and costly requirements of premarket review. As a result, send-out test volumes are increasing.

The U.S. Laboratory Reference Testing: Market Profile & Trends 2024-2027 has been written to help laboratories make more informed decisions regarding the tests they refer out, the prices they pay and how changes in referral and contracting processes might cut costs.

Our Research Methodology

The U.S. Laboratory Reference Testing: Market Profile & Trends 2024-2027 includes data gathered the old-fashioned way—through primary research. The estimates and market analysis in this report have been built from the ground up. Our proprietary reference testing survey combined with extensive interviews with commercial lab executives, hospital lab directors, and respected consultants form the basis of this report. And no stone has been left unturned in our examination of Medicare test volume and expenditure data, hospital cost reports, Securities & Exchange Commission filings and non-profit company tax reports.

About the Author

Jondavid Klipp is president and publisher of Laboratory Economics LLC, an independent market research firm focused on the business of laboratory medicine. Prior to founding Laboratory Economics in April 2006, Mr. Klipp was managing editor at Washington G-2 Reports. During his seven-year employment with G-2, he was editor of Laboratory Industry Report and Diagnostic Testing & Technology Report. Prior to joining G-2, Mr. Klipp was an HMO analyst at Corporate Research Group in New Rochelle, New York, and a senior writer in the equity research department at Dean Witter in New York City.

Jondavid Klipp is president and publisher of Laboratory Economics LLC, an independent market research firm focused on the business of laboratory medicine. Prior to founding Laboratory Economics in April 2006, Mr. Klipp was managing editor at Washington G-2 Reports. During his seven-year employment with G-2, he was editor of Laboratory Industry Report and Diagnostic Testing & Technology Report. Prior to joining G-2, Mr. Klipp was an HMO analyst at Corporate Research Group in New Rochelle, New York, and a senior writer in the equity research department at Dean Witter in New York City.