Publicly Traded Lab Revenue Up 5% In First-Half 2024

Publicly Traded Lab Revenue Up 5% In First-Half 2024

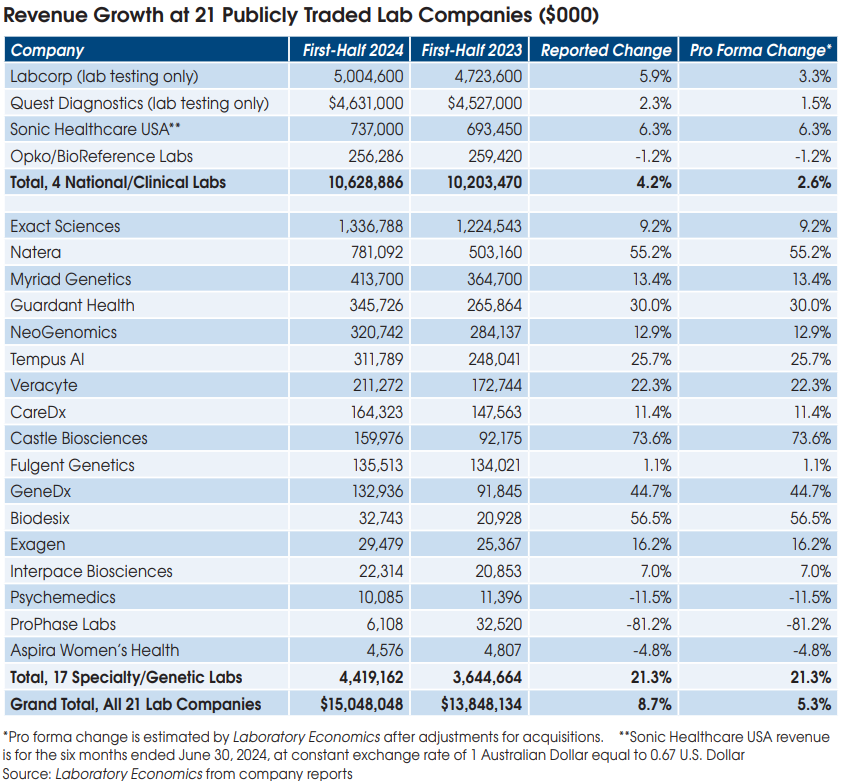

On a combined basis, 21 publicly traded labs reported revenue growth of 5% to reach $15 billion during the first six months of 2024 (after adjusting for acquisitions), according to financial reports collected by Laboratory Economics.

Among four national clinical labs (Quest Diagnostics, Labcorp, Sonic Healthcare USA and BioReference), combined revenue grew by 2.6% (after adjusting for acquisitions).

Meanwhile, among 17 specialty and genetic testing labs, combined pro-forma revenue increased by 21%.

Revenue growth was fastest at Castle Biosciences (Friendswood, TX), up 74% to $160 million. Castle’s lead product is its DecisionDx-Melanoma test for cutaneous melanoma (CPT 81529 at a Medicare rate of $7,193). Reported test results for DecisionDx-Melanoma increased by 11% to 17,969 tests in the six months ended June 30, 2024. Castle’s fastest-growing test was its TissueCypher Barrett’s Esophagus test (CPT 0108U at a Medicare rate of $4,950). Reported test result volume for TissueCypher was up 190% to 8,211 tests.