Cancer Diagnoses Declined Sharply During First Year of Pandemic

Cancer Diagnoses Declined Sharply During First Year of Pandemic

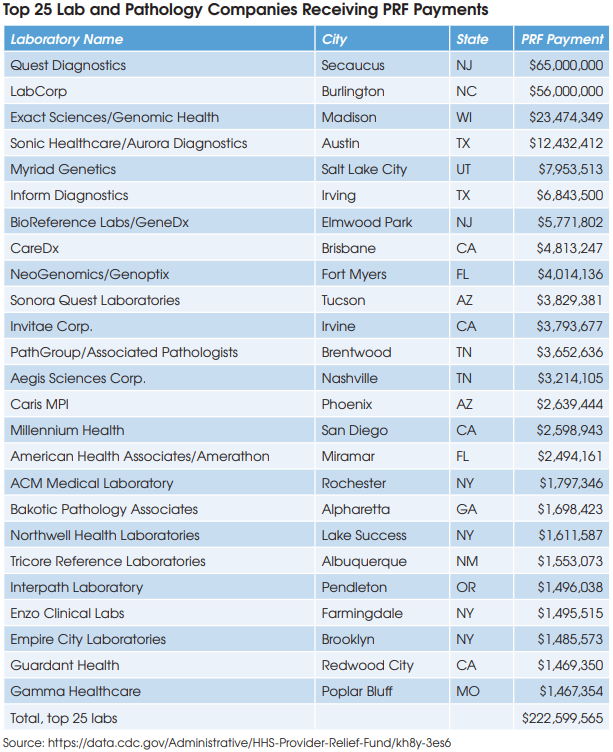

New diagnoses of eight common cancers (prostate, breast, colorectal, lung, pancreatic, cervical, gastric and esophageal) significantly declined during most of the first 13 months of the pandemic (March 2020-March 2021), according to a study by Quest Diagnostics published August 31 in JAMA Network Open, Oncology. It is believed to be the largest and most comprehensive analysis of cancer diagnosis rates during the pandemic.

Lockdown measures and fear of going to doctor’s offices and hospitals are believed to have led many people to put off preventative care like routine screenings that could have resulted in diagnosis of cancer during the first year of the pandemic, the study suggests.

The Quest study included 799,496 patients (45% women/55% men) with an average age of 68. Data over four time periods was analyzed: prepandemic, March to May 2020, June to October 2020, and November 2020 to March 2021.

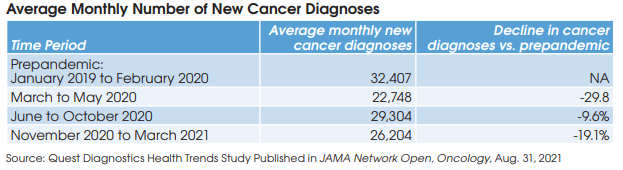

Prepandemic, January 2019 to February 2020, the average monthly number of new diagnoses for the eight cancers was 32,407. During March to May 2020, the monthly average fell by 30% to 22,748 cases. It fell by 10% to 29,304 cases in the next period, June to October 2020. Finally, new cancer diagnoses fell 19% to an average 26,204 cases in the last period, November 2020 to March 2021.

Delayed cancer diagnosis can lead to more advanced disease, more aggressive and costly treatment, and worse outcomes, noted the Quest study.

ACLA Study Cites Emerging Crisis of Undiagnosed Diseases and Delayed Treatment

A separate study of Medicare claims data found that clinical lab test utilization overall fell by 18% from 2019 to 2020, even when taking into account the large volume of Covid-19 testing conducted in 2020. The study was sponsored by the American Clinical Laboratory Association and performed by Braid Forbes Research (Silver Spring, MD). The analysis compared the volume of CLFS tests for Medicare beneficiaries in the first nine months of 2020 to the volume of tests performed in the same period of 2019. Key findings included:

Cancer testing decreased by 31% on average across key tests, including:

• EGFR test volume for non-small cell lung cancer fell by 47%

• BRCA test volume for breast and ovarian cancer fell by 35%

• Prostate specific antigen (PSA) test volume fell by 16%

Diabetes testing decreased by 29% on average across key tests, including:

• A1c test volume fell by 20%

• Glucose test volume fell by 36%

Other tests seeing substantial volume declines included chronic kidney disease (-31%), liver disease (-23%), lipid panel (-22%) and drug testing (-21%).