Labcorp to Buy Tufts Outreach Lab Assets

Labcorp to Buy Tufts Outreach Lab Assets

Tufts Medicine (Boston, MA) is selling its clinical lab outreach business to Labcorp for an undisclosed amount. The transaction, which

does not involve anatomic pathology services, is expected to formally

close in October. Tufts says the sale is the first step towards a broader

partnership with Labcorp. The announcement comes as Tufts endures

prolonged financial difficulties that led Fitch Ratings to downgrade its

debt rating from BBB+ to BBB earlier this year.

Tufts Medicine (TM) includes three hospitals in the Boston area, including Tufts Medical Center (405 beds), Lowell General Hospital (390 beds) and Lawrence Memorial Hospital of Medford (216 beds). It also includes Tufts Medicine Integrated Network, which has more than 1,800 affiliated community and academic physicians.

The annual lab department budget at TM’s three hospitals is a combined $122 million, according to Medicare Hospital Cost Reports. Laboratory Economics estimates that TM’s clinical lab outreach business has annual revenue of roughly $30 million. Labcorp is expected to make job offers

to nearly all 574 TM lab employees affected by the sale.

TM lost $399 million on operations in the fiscal year ended Sept. 30, 2022. TM management estimates that approximately $129 million of the losses were related to one-time items, including the stoppage of elective surgeries due to the pandemic (a $58 million loss of revenue) and installation of the electronic medical records system Epic ($71 million). The largest component of the rest of the operating loss was $217 million for increased staffing costs. The amount TM paid for contract labor increased an incredible 1,423%, to $155 million in the 12 months that ended Sept.

30, 2022, compared to pre-pandemic in 2019.

In addition, TM is facing stiff competition for hospital patients from Massachusetts General Hospital (Boston), which is aggressively competing for managed care contracts.

Sizing Up the Boston Lab Market

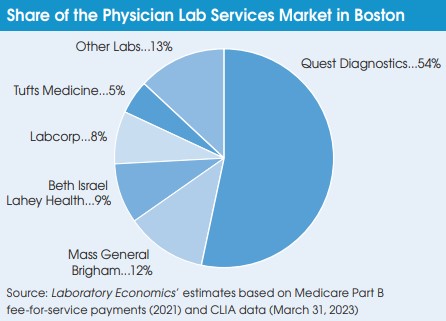

The Boston-Cambridge-Newton metropolitan area has a population of 4.9 million with an estimated physician lab services market of $650 million per year.

Quest Diagnostics has by far the largest market share in the Boston area. Quest purchased the Worcester-based clinical lab outreach business of UMass Memorial Medical Center in 2013. Quest then consolidated testing at a new 200,000-square-foot lab in Marlborough (30 miles west of Boston). Quest has a total of more than 100 patient service centers in the Boston area. It generates an estimated $350 million in revenue from physician office clients in the Boston area.

Labcorp has 15 PSCs in the Boston area and estimated physician client revenue of $50 million… per year (excluding Tufts Medicine deal). Labcorp’s nearest major regional lab is located in Raritan, New Jersey (~5-hour drive)

Mass General Brigham provides lab outreach testing at several hospitals in the Boston area, including Massachusetts General Hospital (1,019 beds), Brigham and Women’s Hospital (812 beds) and Newton-Wellesley Hospital

(273 beds). Total estimated annual lab outreach revenue from the physician office market is $75 million.

Beth Israel Lahey Health operates its biggest hospital-based outreach

labs at Lahey Hospital and Medical Center Burlington (345 beds), Beth

Israel Deaconess Medical Center (743 beds) and Winchester Hospital (194 beds). Total estimated annual lab outreach revenue from the physician office market is $60 million.