Quest Diagnostics has agreed to acquire certain outreach lab assets from

Northern Light Health (Brewer, ME), an integrated healthcare system,

in an all-cash transaction. In addition, Quest will manage nine of Northern

Light Health’s inpatient hospital labs, along with its cancer center lab at

Northern Light Cancer Care in Brewer, Maine.

Northern Light Health’s outreach lab services business does business as Northern Light Laboratory (formerly named Affiliated Laboratory Inc.). It has 225 employees and is based at a core laboratory in Bangor, Maine. It serves 250 physician practices throughout the region and provides

reference testing services to more than two dozen hospitals.

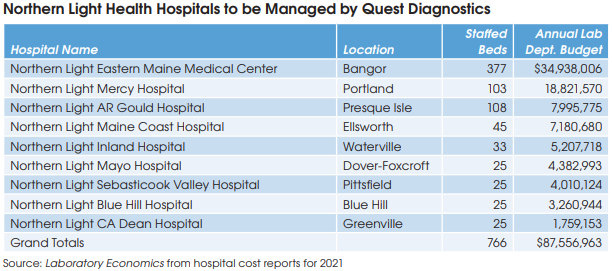

Northern Light Laboratory is operated as a hospital-owned independent lab. It collected $1.5 million of Medicare Part B Carrier allowed revenue from 135,489 allowed tests in 2020 (the latest year of available data). Laboratory Economics estimates that overall revenue for Northern Light Laboratory is between $10 million and $20 million per year.

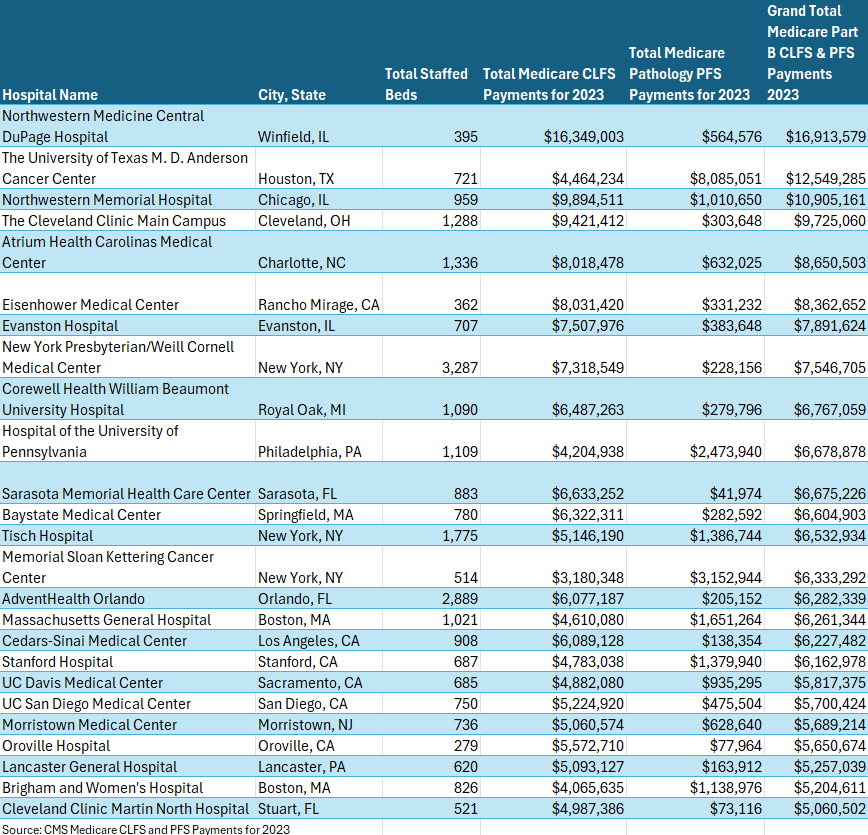

Northern Light Health has a systemwide laboratory department budget of $88 million, according to hospital cost reports for 2021. Its largest inpatient lab is at Northern Light Eastern Maine Medical Center (377 staffed beds), which has a lab department budget of $35 million per year.

Non-urgent routine clinical lab testing and reference testing now performed by Northern Light Laboratory will be shifted to Quest’s regional lab in Marlborough, Massachusetts (about 250 miles from Bangor). A Quest rapid response lab in the Bangor area and select Northern Light Health hospital labs will perform tests requiring rapid results.

Northern Light employees working in the labs will become Quest employees, and no one is being laid off, according to Northern Light spokesperson Suzanne Spruce.

In addition, Spruce says that the agreement with Quest will not affect anatomic pathology services that are now provided at Northern Light Health by Dahl-Chase Pathology Associates (Bangor, ME).

“This agreement will bring Quest scale in Maine. This market is largely a white space for Quest and the transaction makes strategic sense to both parties. It will create a low-cost consolidated lab in a state currently dominated by NorDx Laboratories,” observes David Nichols, President of

Nichols Management Group (York Harbor, ME).