Following cancellation last year due to the pandemic, the New York State Clinical Laboratory Association (NYSCLA) held this year’s annual meeting in a well-spaced conference room in Albany, October 6-7. Approximately 125 lab directors, managers, pathologists and vendors were in attendance—down from the average 200+ at pre-pandemic NYSCLA meetings. Key topics discussed included the outlook for the Medicare CLFS under PAMA, the New York clinical lab response to the pandemic, workforce shortages, and the risks and ethical challenges of using artificial intelligence in healthcare. Below are brief summaries of several speaker presentations.

Alan Mertz, Director of Government Relations at NeoGenomics (Fort Myers, FL), said the lab industry, led by the American Clinical Laboratory Assn. (ACLA), is lobbying to have Medicare CLFS rates frozen for another year in 2022. This would delay scheduled Medicare rate cuts of up

to 15% for most high-volume clinical lab tests, but would not change the second PAMA private payer data reporting period for labs of January to March 2022.

Another one-year delay would give the lab industry time to try to get legislative changes to PAMA that ensure that all lab providers (independents, hospitals and POLs) are accurately represented through statistical sampling when CMS calculates new CLFS rates for 2023-2025. Other changes sought by ACLA included limiting annual CLFS rate changes to between +5% and -5% per test, increasing the length of time between each data collection period from three years to four years, and excluding Medicaid managed care rates from future surveys.

Mertz noted that ACLA’s PAMA lawsuit against HHS/CMS, initially filed in December 2017, has been going on for nearly four years. Most recently, a federal district court dismissed the lawsuit in March, ACLA filed a notice of appeal in May, and hearings are expected to begin later this year.

Separately, Mertz noted that the lab industry has been trying to get clarity from the Department of Justice on the scope of the Eliminating Kickbacks in Recovery Act of 2018 (EKRA) for the past two years. A provision in the EKRA outlaws most traditional volume-based commissions paid to lab sales reps. EKRA was initially intended to target abusive kickback relationships between toxicology labs and addiction treatment centers. It doesn’t look like this will be enforced against legitimate labs, but a formal DOJ opinion is needed, according to Mertz.

Finally, Mertz said that ACLA is supporting the VALID Act, which would grandfather in existing laboratory-developed tests (LDTs), but require FDA regulation of new LDTs. This would be preferable to any potential FDA regulations that might be developed under the notice- and-comment

rulemaking process. Mertz believes the VALID Act has a chance to pass into law as an attachment to either a drug or medical device user fee reauthorization bill in 2022.

Brian Jackson, MD, Medical Director of Support Services, IT, and Business Development at ARUP Laboratories (Salt Lake City, UT), discussed the potential risks and ethical issues associated with using big data and AI in healthcare. Jackson noted how machine learning programs in

the past had developed biases as a result of being trained on non-diverse datasets.

Violation of patient privacy is another risk. Jackson noted that Target and other retailers have developed algorithms so sophisticated that they can identify personal medical information based on an individual’s purchasing patterns. He cited a study that found that 99.98% of Americans could be correctly re-identified in any de-identified dataset by cross-referencing 15 demographic attributes (Nature, July 23, 2019).

Jackson warned that current FDA regulations of medical AI algorithms are too lax and require very little to achieve clearance. According to a study of 130 medical AI algorithms approved by the FDA between 2015 and 2020: 1) most were based on retrospective data only; 2) 93 out of the 130 devices had only single-site evaluation; and 3) only 17 reported that demographic subgroups were analyzed. [see Wu et al. Nature Medicine 2021;27:576-54]

Jackson urged labs to perform their own validation and quality control studies on new AI applications they deploy, just as they would when adding a new chemistry assay.

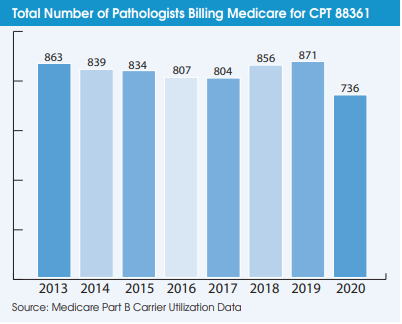

On the question of AI algorithms someday replacing pathologist interpretations, Jackson said pathologists may find themselves signing out more cases per day, but “I don’t see pathologists being

out of work any time in the near future.”

James M Crawford, MD, PhD, Senior Vice President of Laboratory Services at Northwell Health, noted that Northwell Health Laboratories (system-wide, inclusive of hospital lab-based and Core Lab-based testing, but not including rapid tests performed at Urgent Care Centers) is in the range of 5,000 to 8,000 Covid-19 PCR tests per day. Current positivity rates are hovering between 3% to 4%, according to Crawford.

Positivity rates had averaged more than 70% at Northwell Health at the peak of the pandemic in the New York City area in early April 2020. “We’ve probably never seen that high of a percentage positivity rate for any other pathogen,” noted Crawford.

He said that serological tests ordered by physicians and resulted by Northwell Health Laboratories are currently averaging about 90% positive for antibody tests for “Ig-S” (presumably a reflection of vaccination-related testing) and about 40% for antibody tests for “Ig-N” (presumably tests ordered to see whether a patient had recovered from natural infection). Crawford noted that this testing is from a population in which physicians wanted to know the test results and cannot be viewed as a “serosurvey” of the general population.

Crawford believes the New York City region will continue to see a steady rate of Covid-19 positivity, but that societal function and healthcare delivery will be relatively sturdy through the coming winter months. “Covid-19 will be with us for the foreseeable future. The key is staying committed

to our careful ways in co-existence with Covid-19.”

Carlos Cordon-Cardo, MD, PhD, Chairman, Department of Pathology, Molecular and Cell Based Medicine at Mount Sinai Health System (MSHS-New York City), described Mount Sinai’s transition to digital pathology. The timeline included the initial purchase order for Philips IntelliSite Pathology Solution in June 2019, integration of Philips-Sunquest and the MSHS LIS barcode system in late 2019, and going live for clinical diagnostics in early 2020. Labcorp, which acquired the MSHS clinical lab outreach business in 2017, helped with the digital pathology implementation. Cordon-Cardo says that MSHS pathologists are now using a combination of traditional microscope and digital pathology to interpret cases.

“Staffing has become the number one thing on everybody’s mind,” noted NYSCLA President Eloise Aita, PhD. She noted that approximately 50% of lab workforce is over the age of 55. Last year, the number of new NYS licensed clinical laboratory technologists fell by 17% to 304, while the number of new clinical lab technicians fell by 8% to 73. Challenges to attracting new workers include poor visibility of the specific occupations in the laboratory and limited job advancement opportunities, according to Aita. “The pandemic has shone a light on the importance of our industry, let’s take advantage of that.”