BioReference Labs Goes Live With Digital Pathology Plus AI

BioReference Labs Goes Live With Digital Pathology Plus AI

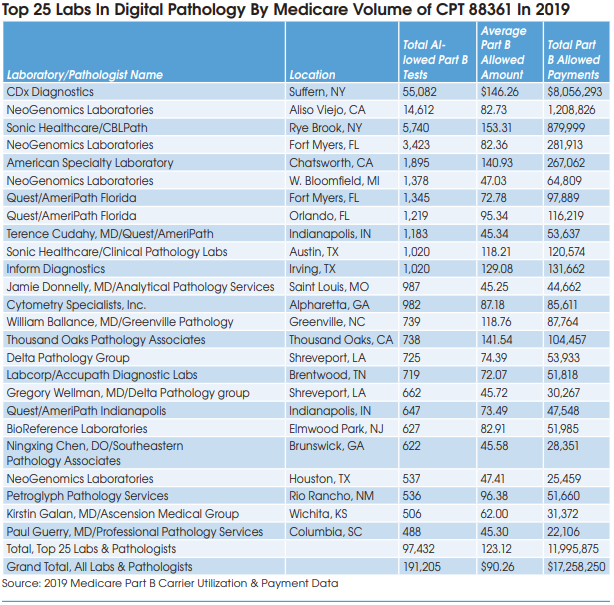

OPKO’s BioReference Labs (Elmwood Park, NJ) went live in December with new whole-slide imaging scanners from Leica Biosciences (Buffalo Grove, IL). The scanners have been integrated with a digital pathology solution, PathFlow, made by Gestalt Diagnostics (Spokane, WA). PathFlow is a cloud-based software system that has helped integrate BioReference’s LIS, workflow and scanned slide images with artificial intelligence algorithms developed by MindPeak (Hamburg, Germany). BioReference is also using PathFlow for slide image management and archival storage.

BioReference is using MindPeak’s AI tool (named BreastIHC) to detect and quantify breast cancer cells from digitized slide images with immunohistochemistry at its main laboratory in northern New Jersey. Pathologists can access their case and slide images securely on their computer monitors and use their mouse to outline regions of interest (ROI). All cells within this outlined ROI are instantly classified into positively stained tumor and unstained tumor cells. The panel of algorithms include five key tumor markers (ER, PR, Ki-67, HER2, and P53) which can be counted and scored.

Eventually, Dan Roark, Chief Executive Officer, Gestalt Diagnostics, expects the AI algorithms to both automatically identify the regions of interest in addition to performing IHC marker positivity scoring.

Digital Pathology & AI Market Growth

Separately, Roark says that after more than 10 years of limited adoption, digital pathology is finally starting to take off in the clinical market in the United States. Whole slide scanners have gotten quicker and less expensive. For example, it used to take 8-10 minutes to scan a slide but now takes as little as 30 seconds. But the biggest driver is the pathologist efficiency gains obtained when AI is applied to digitized slides. “The number of RFP requests we receive is exploding,” says Roark.

Worldwide Opportunities for U.S.-Based Pathologists

The U.S. has more working pathologists per capita than most other countries. For example, there are approximately 20,000 actively practicing pathologists in the United States, according to the American Medical Association. This works out to a ratio of one pathologist for every 17,000 people.