Laboratory Economics Issues Research Report on U.S. Anatomic Pathology Market

Laboratory Economics Issues Research Report on U.S. Anatomic Pathology Market

The publisher of Laboratory Economics has just released The U.S. Anatomic Pathology Market: Forecast & Trends 2019-2021. With this special report, you can tap into 150 pages of proprietary market research that reveals critical data and information about key business trends affecting the anatomic pathology market.

The report reveals that the anatomic pathology market (including Pap testing) now represents an estimated $18 billion of revenue with an annual growth rate of 3-4%. All data and trends are fully explained throughout the report, including 10-year historical data and a detailed three-year forecast.

The U.S. anatomic pathology market endured intense reimbursement pressure between 2013 and 2017. “However, the Medicare program has completed its evaluation of payment rates for all the key pathology codes and the reimbursement environment now appears stable,” according to Jondavid Klipp, Publisher of Laboratory Economics. “Furthermore, the introduction of new higher-priced molecular oncology tests linked to targeted cancer drugs is driving volume trends higher. As a result, the outlook for the U.S. anatomic pathology market is the best it’s been in the past 10 years.”

The report includes:

- More than 100 charts and graphs

- Industry size and growth rates

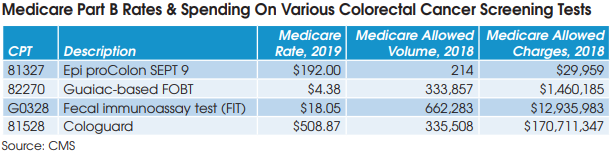

- Detailed estimates for market subsets like prostate cancer testing, dermatopathology, lymphoma/leukemia and gastrointestinal

pathology - Medicare claims data for 60 key pathology codes

- Cervical cancer testing trends and pricing data

- In-office histology lab trends

- Detailed analysis of the digital pathology market

- Results from Laboratory Economics’ exclusive Anatomic Pathology

and Clinical Lab Trends Surveys from 2007 through 2019

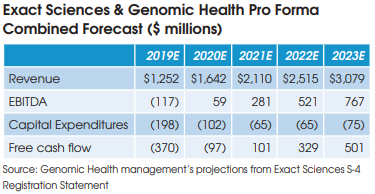

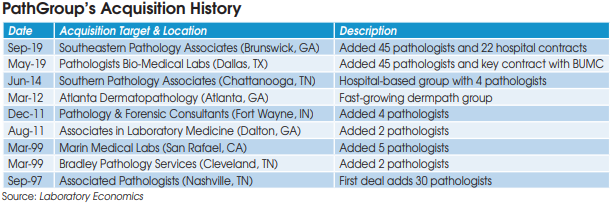

Anatomic pathology companies featured in this report include: Aurora Diagnostics, Bako Diagnostics, CellNetix Labs, Exact Sciences, Genomic Health, InformDX, LabCorp/Dianon, Myriad Genetics, Mayo Clinic Labs, NeoGenomics, OPKO/BioReference Labs, PathGroup, Pathology Reference Laboratory, Poplar Healthcare, ProPath Services, Quest Diagnostics/AmeriPath and Sonic Healthcare USA.

The U.S. Anatomic Pathology Market: Forecast & Trends 2019-2021 is published by Laboratory Economics (www.laboratoryeconomics.com), an independent market research firm focused exclusively on the business of pathology and laboratory medicine.

Contact Information

Contact: Jondavid Klipp, President

Laboratory Economics

195 Kingwood Park

Poughkeepsie, NY 12601

Phone: 845-463-0080

www.laboratoryeconomics.com