Top 25 Independent Nursing Home Labs

Top 25 Independent Nursing Home Labs

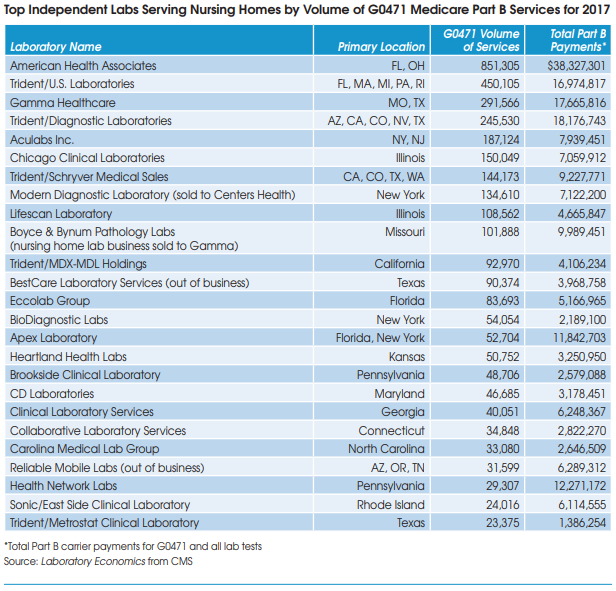

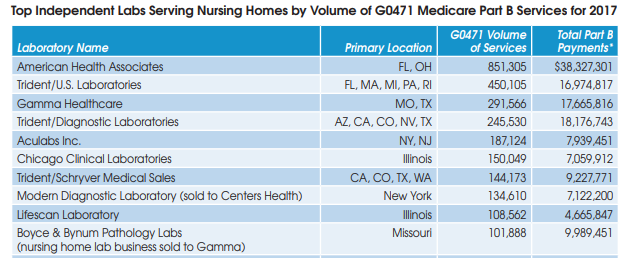

There are approximately 75 independent lab companies across the United States that are focused on the nursing home market. The table below lists the top 25 companies as measured by their volume of Part B services for G0471 in 2017 (the latest year of available data). G0471 is the billing code used exclusively for blood draws taken from nursing home and home health patients.

On a consolidated basis, TridentUSA Health Services is the largest nursing home lab with combined volume of 956,153 for G0471 at five lab subsidiaries in 2017. Its total Part B payments for all testing services was $50 million in 2017.

American Health Associates (Miramar, FL) is next with volume of 851,305 for G0471 and total Part B payments of $38 million in 2017.

Gamma Healthcare (Poplar Bluff, MO) is third largest with G0471 volume of 291,566 and total Part B payments of almost $18 million in 2017. In addition, Gamma acquired the nursing home lab business of Boyce and Bynum Pathology Laboratories (Columbia, MO) in late 2018.