Last month, LE briefly noted that CorePlus Servicios Clínicos y Patológicos LLC (Carolina, Puerto Rico) had become the first independent lab in the Americas to begin using artificialintelligence-assisted (AI) pathology for prostate cancer diagnostics. This month wegot in touch with CorePlus President Mariano de Socarraz to find out more.

Can you describe CorePlus?

We opened our CLIA-certified laboratory in Carolina, Puerto Rico in 2008. We currently have 115 employees, including four pathologists. CorePlus is full-service independent laboratory. Among our specializations is uropathology. We process approximately 3,000 prostate cancer cases (~36,000 slides) per year, representing more than half of all outpatient prostate cancer biopsies performed in Puerto Rico.

Is operating a lab in Puerto Rico different than in mainland United States?

No. Puerto Rico is a U.S. territory that must follow all federal lab regulations, including CLIA. Medicare and Medicaid insurance cover the majority of the 3.2 million people living in Puerto Rico and the biggest private insurer is Triple-S, which is an independent licensee of the Blue Cross Blue Shield Association. The biggest difference is probably reimbursement rates, which are substantially lower in Puerto Rico.

Among the competing clinical labs in Puerto Rico are Laboratorio Clinico Toledo and Laboratorios Borinquen. Anatomic pathology labs include Hato Rey Pathology and Puerto Rico Pathology. Quest Diagnostics has had a reduced presence following the damage to its lab facilities from Hurricane Maria in 2017. LabCorp transports specimens to its labs in Florida.

When did CorePlus transition to digital pathology?

We began digitizing slides using 3DHISTECH scanners in mid-2019. By late 2019 we had completed validation and by early 2020 our pathologists were reading digitized images for all our pathology cases, including all routine histopathology and stains.

What type of computer screens do your pathologists read the digital slide images from?

CorePlus validated the Dell UltraSharp 49 Curved Monitor – U4919DW. It’s a high-end, business grade monitor with a Delta E of <2 (color difference perception) and an aspect ratio of 32:9:0. This aspect ratio is the equivalent of two 27-inch monitors running at 2K.

And how did you get involved with AI-assisted pathology?

In August 2018, I read about a validation study conducted by University of Pittsburgh Medical Center which used an AI-based algorithm to detect and characterize prostate cancer from digitized slides. This study [recently published in The Lancet Digital Health] showed that an AI-based algorithm demonstrated 98% sensitivity and 97% specificity at detecting prostate cancer from 1,600 different tissue slide images that had been collected from 100 patients seen at UPMC who were suspected of having prostate cancer. It even spotted six potentially malignant slides that expert pathologists had failed to identify initially. This interested me, so I contacted the company that developed the algorithm, Israel-based Ibex Medical Analytics. We ran our own validation studies on 1,301 digitized prostate tissue slides and found results similar to those at UPMC. Overall accuracy was 99.4% with 96.9% specificity and 96.5% sensitivity.

How have you integrated AI into your pathology lab?

Our pathologists continue to read digitized images for every prostate tissue slide prepared by our lab. But starting in June, we also began sending digitized images of each slide to the Ibex cloud. Ibex runs its AI-based algorithm on each slide which provides 100% quality control on all prostate cases. This serves as a digital second opinion for our pathologists.

What happens when there is a discrepancy between the pathologist’s exam and the algorithm?

The pathologist goes back and reviews the slide(s) and/or orders an immunohistochemistry. I believe that we have reduced the potential for a misdiagnosis on prostate cancer biopsies to much less than 1%. This is significant given that even an expert uropathologist can miss 3%. So the AI

algorithm is acting as a failsafe that is catching cases that might otherwise be missed.

Was there any reluctance from your pathologists as you transitioned to digital pathology and AI for prostate?

The pathologists were always fully engaged in the transition. Our pathologists say they would never go back to the microscope, especially given their ability to read digitized slides at home during the pandemic. We have analyzed over 1,000 prostate biopsy cases using digital pathology with AI assistance to date. In real world practice it has helped identify lesions that would otherwise have been missed.

Will you apply AI-based algorithms to other cancers?

Yes, we are planning to start using an Ibex algorithm for second reads on all breast cancer cases within the next few weeks.

How does your lab get compensated for using digital pathology and AI to improve accuracy?

We do not get additional compensation and that is the problem with the current CPT-based feefor-service reimbursement model. AI increases accuracy and reduces utilization of immunohistochemistry and there ought to be some coding mechanism that fairly compensates labs that use it.

In the meantime, the increased efficiency that the combination of digital pathology and AI provides has helped offset the initial technology investment and development cost. In addition, the increased accuracy at CorePlus through its use of AI should lead to more clients. Knowing that 100% of prostate cancer cases sent to CorePlus are getting an AI second opinion should raise urologists’ confidence in our lab.

How will AI affect the practice of pathology over the long term?

After our current use of digital pathology and AI as a second read tool, I anticipate it will progress to be used as a triage tool and finally for primary reads with the supervision of a pathologist. The role of pathologists will evolve away from time at the traditional microscope toward selecting the

right AI algorithm to apply to a digitized slide and reviewing results in combination with a patient’s medical record to form a diagnosis.

Switching gears, is CorePlus performing Covid-19 PCR testing?

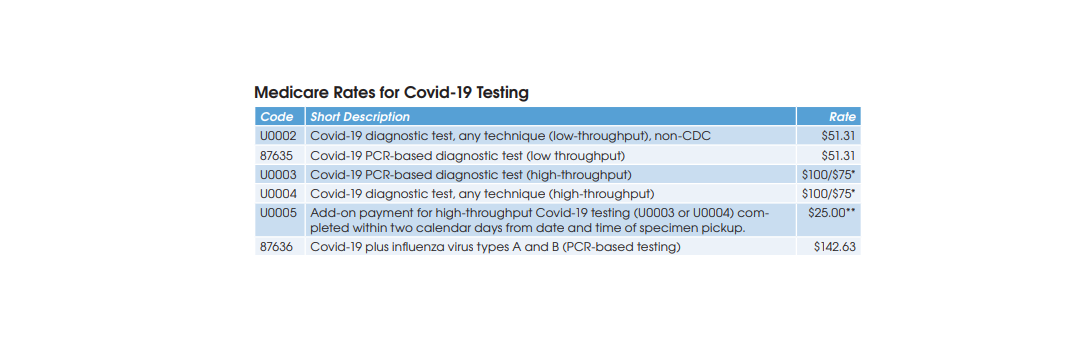

We started Covid-19 PCR testing on the Roche cobas 6800 platform in late April. CorePlus has been on an allocation of seven kits per week (equal to 1,344 tests). To compensate for the test reagent shortage, we began pooled testing for three specimens at a time in July. This has expanded our capacity to about 4,000 tests per week and we are preparing to increase our pool size to six specimens, which will double our capacity to 8,000 tests per week.

How do you see the Covid-19 pandemic ending?

It is not going away any time soon, even with a vaccine. Population immunity may take years.